Caixin Insight: New Infrastructure and Old Street Stalls

Hainan free trade zone

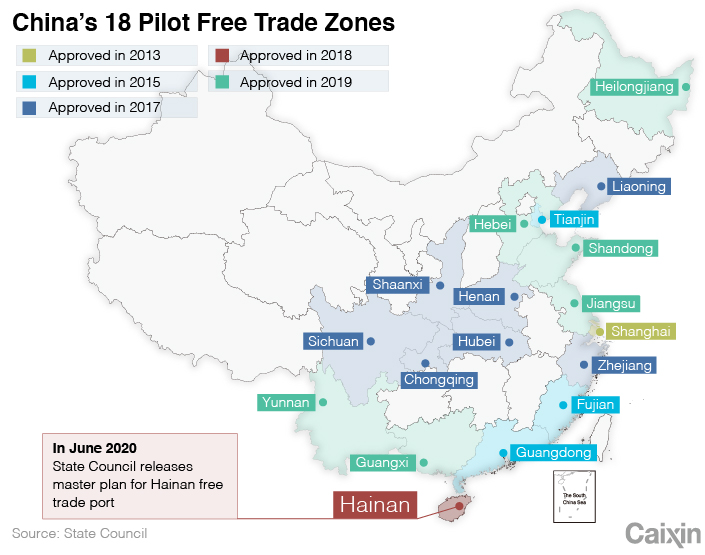

The State Council and Central Committee released a major plan on Monday to turn Hainan into a free trade port. Caixin has a rundown of the top 60 measures available in English and Chinese here.

They include

- tax breaks and softer regulation that will make foreign trade and investment easier

- measures to facilitate foreign investment, business, travel and employment

- a greater deal of liberty for the provincial development and reform commission, including to choose its own projects and approve issuance of foreign-denominated bonds

- Ship registry and air traffic facilitations

The initiative has backing from the very top as a pet project of President Xi’s, and is distinct from free trade zones in other places; it is broader and covers more than just trade in goods, opening regulation surrounding investment, finance and trade, employment, and more. Wang Yang, a former vice premier, described it as a “special economic area with the highest level of openness in the world.” The free trade port designation will also support Hainan’s ability to engage in intermediary trade, which helped fuel the rise of Hong Kong and Singapore as major hubs, and must be facilitated by financial opening.

|

The Hainan free trade port also ventured further than China’s other FTZs, in that Hainan opened up some of the items on the “negative list” for foreign investment in other FTZs, such as higher education and telecom. For the first time China allowed foreign higher education institutions to operate independently in China without the need of a local partner. Telecommunications was another taboo area for foreign companies, opening basic telecom and the value-added telecom services, the latter encompasses a broad range of tech services, will give foreign tech companies the precious opportunity to access the China market.

The zone will be China’s closest yet to “three zero” (zero tariff, zero barrier, zero subsidy) trade policies that are becoming a trend internationally and came to the fore last year when advocated by Huang Qifan, executive vice president of the China Center for International Economic Exchange.

One challenge the zone may face, however, is internal competition — Shanghai has tried and mostly failed so far to develop intermediary trade in its Lingang New Area FTZ, and the country already has 18 FTZs, so Hainan will need to differentiate itself.

Monthly Caixin Indexes

Manufacturing PMI

-Rose to 50.7 from 49.4 in April

-The reading was the highest since January, before the Covid-19 outbreak took hold in the country, and adds to evidence the country’s vast manufacturing sector is regaining momentum after economic data for April — including fixed-asset investment, industrial output and retail sales — showed the slump in the first quarter is being reversed.

-Improvement in the headline number was driven by production, with the output subindex reading rising to its highest since January 2011.

-“Sluggish exports remained a big drag on demand as the virus continued spreading overseas,” noted our colleague Wang Zhe, a senior economist at Caixin Insight Group.

Services PMI

-Jumped to 55 last month from 44.4 in April

-Measure for new business in the services sector reached its highest point in almost 10 years, returning to positive territory

-Major drag on services last month was sluggish external demand, as many countries had not lifted lockdowns imposed to counter the coronavirus pandemic. The gauge for new export business in the services sector remained in contractionary territory for the fourth straight month

-Gauge for employment stayed in negative territory for the fourth month in a row despite a slight increase

NEI

-Came in at 31.1 in May, indicating that new economy industries accounted for 31.1% of China’s overall economic input activity, down from 32.1 the previous month

-All three sub-indexes (technology, capital and labor) that make up the NEI fell. The one for technology inputs, which has a 25% weighting in the index and measures the number of research personnel recruited by the tracked industries, the number of inventions they create and the number of patents they obtain, declined by 2 points month-on-month to 30 in May, the biggest contributor to the NEI drop

-The NEI also tracks the daily flow of people in companies, office buildings and shopping malls, which helps measure the extent to which businesses have gotten back to work. In May, it found the flow of people in office buildings returned to 80% of where it was before the Lunar New Year holiday in late January.

New Infrastructure

As you should know if you’ve been reading this newsletter, “new infrastructure” (see “Defining ‘new infrastructure’ from April 25) is among the hottest economic policy topics at the moment, and its importance was reinforced at the Two Sessions last week. The government work report raised the local government special purpose bond quota to 3.75 trillion yuan, a 1.6 trillion yuan increase year-on-year, and said to prioritize new infrastructure and new urbanization projects.

However, most of the investment in new infrastructure is meant to come from companies, which have responded enthusiastically: In April, Alibaba announced it would spend 200 billion yuan over the next three years on data centers and other facilities, and on May 26, Tencent said it would spend 500 billion over the next five years to lay out new infrastructure.

But despite the hype, new infrastructure investment remains small (roughly 10% of total infrastructure investment last year) and there are doubts about its ability to transform traditional industries, which drive much greater investment and consumption.

A number of Two Sessions representatives brought up such concerns. Much of the discussion revolved around 5G and security, which we’ll save you from reading again (here in Chinese if you just can’t get enough 5G content.)

But the main thrust of the conversation is that while policy and funding directions have been made clear, implementation has not. It’s expensive to build it out, applications are few and far between, and the applications that do exist may not be a good fit for China’s existing economic structure. (As the proud owner of a 5G phone, I can tell you the only difference from 4G phones is the price tag.)

Sun Pishu, chairman of Inspur and an NPC representative, told Caixin that while people talk about cloud computing and big data “giving wings” to SMEs, the SMEs themselves don’t agree. Instead, they feel that industrial internet is part of the world of big companies, and thinking about entering that world or spending hundreds of thousands of yuan on a robot “strikes fear into their hearts.”

One solution to the issue, Sun noted, is for government and big tech companies to work together on providing high tech services as infrastructure. As we noted in our April 22 newsletter, data is a production factor. Now, local governments are promoting data and computing centers built by BAT to provide SMEs with the ability to do smart industry. For now, China’s data centers remain largely traditional and focused on storage rather than computing; to integrate them with industry China will need to spend more effort processing all that data and develop usable AI applications.

The NDRC also brought up regional data centers as a way to address regional discrepancies: data centers in Beijing and Shenzhen are sought after, but data centers in less developed areas find it hard to attract enough users. Building regional data centers that serve several provinces can help better allocate computing and storage capacity.

Street Stalls as a Way to Prevent Economic Stall

Chinese Premier Li Keqiang has vowed government support for street vendors as part of efforts to ease unemployment and revitalize small businesses following the country’s coronavirus epidemic. Until recent years, the street vendors have been a major contributor to the informal part of the economy in Chinese cities. Local governments came under pressure to remove them as part of “city civility” ratings by the central government, as they were tasked with addressing food safety issues, urban beautification, and reducing pollution from outdoor grills.

The re-introduction of street vendors is a sign of how much pressure China’s economy is facing, and how desperate the decision makers are when it comes to job creation this year. Given the significance of the “top guarantee,” employment, one can easily understand why the central government scratched street vendors from their local government assessment checklist.

Weathervane

Qiushi, the flagship magazine of China’s Communist Party, published a year-old speech (link in Chinese) by President Xi Jinping on Sunday in which he said China had already “basically achieved the goal of building a moderately prosperous society in all aspects.” The speech, entitled “On the problem of addressing shortcomings in building an all-round moderately prosperous society,” paid particular attention to poverty alleviation and pollution control, two of Xi’s three signature battles.

The goal of building a “moderately prosperous society” has been a key guiding concept for decades, first proposed by Deng Xiaoping at the beginning of reform and opening-up, and later broadened to a “comprehensive” moderate prosperity by Xi, incorporating environmental, social and other aspects beyond economic growth.

The primary quantitative target associated with the concept in recent years has been to double China’s GDP from 2010 to 2020. The economic hit from Covid-19 has thrown the viability of reaching that target into question, however, as it would require roughly 5.3% to 5.6% growth for the year, a tall order after the first quarter saw China’s first economic contraction since at least 1992, when record keeping began.

He Lifeng, chairman of the NDRC, commented during the Two Sessions that 3% growth in 2020 would bring the country’s economy to 1.95 times the scale in 2010, and 5% growth would bring it to 1.99 times. He also added that doubling the GDP is only one of the 12 “moderately prosperous society” targets, and that most would be fulfilled by year end, with a handful “basically fulfilled.”

On this point, Xi was also quick to note that the goal does not necessarily imply that all regions will double their GDP or reach the national average level. He further emphasized that cadres should grasp the relationship between relative and absolute indicators, and quantitative vs. qualitative judgements of moderate prosperity.

While the speech was given 13 months ago, Qiushi’s choice to publish it now is an important signal.

It is both a reminder to cadres to keep their eyes on the prize despite China dropping its GDP growth target, and an indicator of flexibility in the party’s ability to determine if the goal has been met. The speech has been followed by official comments softening the target.

Yang Weimin, deputy director of the CPPCC economic committee, echoed He’s comments at a Monday video conference hosted by a state-backed think tank, saying that the target had effectively already been met, and the “key is to win people’s recognition,” the South China Morning post reported.

Contact analysts Gavin Cross (gavincross@caixin.com) and Zhang Qizhi (qizhizhang@caixin.com)

This weekly brief is provided by Caixin Global Intelligence, the strategic advisory arm of Caixin Global. We help clients assess policy risk and macroeconomics in China, providing actionable insight with custom market and policy analysis.

For more analysis, please follow our Twitter @caixin_intel

If you have any inquiries, please contact us at cgi@caixin.com

- GALLERY

- PODCAST

- MOST POPULAR