In Depth: Private Equity Firm Accused of Misconduct in Ant Group Stake Sale Involving Trust Investors

With Ant Group Co. Ltd. readying what is expected to be the largest IPO ever, a Chinese private equity firm has been accused of cheating a group of investors out of possibly millions of dollars by selling their stake in the fintech superstar to its chairman’s brother and sister at a well-below-market price.

The case, which was made public in a social media post published last week, triggered an online uproar, sparking a debate over whether bigwigs in China’s fast-growing private fund industry could easily shove individual investor interests aside for their own personal benefit.

The post mentioned an investor in a fund that owns a 0.1% stake in Ant Group. The fund is managed by private equity firm Primavera Capital Group, whose founder and chairman is Hu Zuliu, who also goes by Fred Hu. Hu used to be a Greater China chairman at investment banking giant Goldman Sachs Group Inc.

In June 2019, the investor and another investor sued Primavera Capital in a Shenzhen court on behalf of more than 100 others who invested in the fund, sources with knowledge of the matter told Caixin. The trial is ongoing.

The investors accused Hu of lacking professional ethics and illegally selling their stake in Ant Group to his siblings, which had caused huge losses for them, without obtaining investor permission, the sources said.

Primavera Capital denied the allegations in a statement (link in Chinese) dated Aug. 29, saying that the investors were not its clients.

“Primavera has never engaged in, and firmly opposes, related-party transactions involving improper gains,” the statement said, adding that the social media post contains “a lot of false information and constitutes defamation and an insult,” seriously damaging the rights of the firm and Hu.

Primavera Capital said it had no further comment in response to a Caixin request.

On Sept. 28, 2011, several hundred investors bought a trust product issued by China Ping An Trust Co. Ltd., which is also a defendant in the investors’ lawsuit, the sources said. A total of nearly 2.1 billion yuan in proceeds from the product’s sales were all invested in a Ping An Trust subsidiary, which then invested the money in the Primavera Capital fund, according to a contract seen by Caixin. The investment product had a maturity of six years, plus an option that allowed investors to extend the date of maturity by two years.

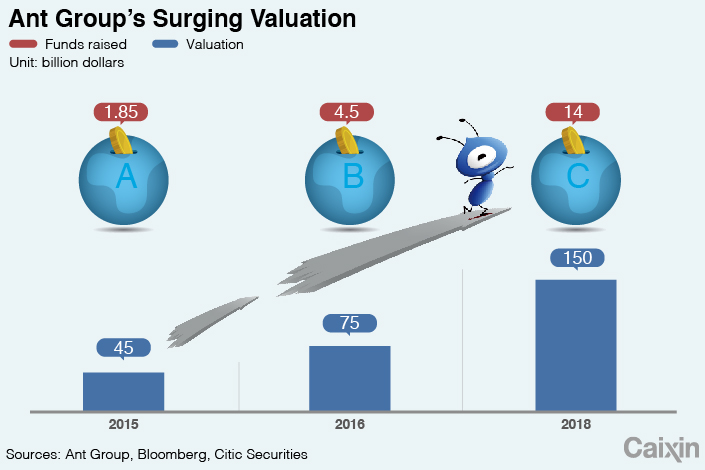

In June 2015, the fund spent 200 million yuan to buy a 0.1% stake in the company now called Ant Group, the fast-growing fintech affiliate of e-commerce giant Alibaba Group Holding Ltd., according to a document seen by Caixin that Ping An Trust sent to investors.

Read more

Cover Story: How Ant Grew Into an Elephant-Sized Behemoth

Ping An Trust said last year that the investors hadn’t reached an agreement to opt for the extension, so the product they invested in had to mature in September 2017, the sources said. In 2017, Ping An Trust said it would delay repaying the investors’ investment in the Ant Group stake until after the company went public, according to a liquidation report seen by Caixin.

Investors told Caixin that they didn’t object the delay on their Ant Group returns because they figured that the value of the stake was only going to go up.

However, early last year, Ping An Trust informed all the investors that their stake in Ant Group had been sold. It did not tell them how much the stake sold for, or who bought it. The investors pushed back on Ping An Trust, asking for details of the stake sale. In April 2019, the firm responded, saying that the stake in Ant Group sold for 449 million yuan.

Based on Ant Group’s valuation in its series C funding round in 2018, a 0.1% stake of the firm would be worth about 960 million yuan at that time. However, pricing of the investors’ 0.1% stake should depend on either market quotations when the deal was made in early 2019 or the company’s valuation after its IPO when they would be able to cash out, industry insiders said.

|

The investors were outraged because they believed the investment in Ant Group would yield some of the juiciest returns of all the investments made by the Primavera Capital fund.

Furthermore, after a months-long investigation, the investors’ legal team discovered that the buyers of their Ant Group stake were Hu Zuwu and Hu Yuanman, the siblings of Fred Hu, the post said.

Hu Zuwu and Hu Yuanman were added to the list of the fund’s limited partners in January 2019. At the same time, the subsidiary of Ping An Trust was removed from the list.

The chairperson of an uninvolved private fund firm told Caixin that the changes to the fund’s partners is evidence that the investors’ allegations may be true, and that Primavera Capital had likely conducted related-party transactions, which should have been disclosed to investors.

In its response on Aug. 29, Primavera Capital said it never engaged in any misconduct. It also argued that the investors who filed the lawsuit did not have legal standing to sue it because they were not its clients. That’s because they never invested directly in its fund.

Even though the Shenzhen court has accepted their lawsuit, the investors don’t have much of a chance of winning, a lawyer who specializes in such cases told Caixin.

As the law currently stands, Primavera Capital has the upper hand. For the investors to beat the firm in court, they would first have won a lawsuit against the trust firm whose trust product they bought, the lawyer said. Only then would they have a shot at getting Primavera Capital in court.

The contract that the investors signed with Ping An Trust also leaves them at a disadvantage. According to the contract, if the trust product does not cash out of its investments by the time it matures, the trust firm can dispose of the assets in any way it sees fit.

Ping An Trust refused to comment on the trial.

This story has been updated with additional information.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- GALLERY

- PODCAST

- MOST POPULAR