Opinion: China to Increase Infrastructure Spending, but No Housing Stimulus for Now

Bo Zhuang is managing director and chief China economist at London-based consulting firm TS Lombard; Jonathan Fenby is chairman of China team and senior consulting analyst at TS Lombard; Rory Green is China economist at TS Lombard.

The National People’s Congress, typically held in March but delayed owing to the coronavirus, has extra significance this year. As we forecast, China abandoned a numerical GDP target for 2020, with the Government Work Report placing more emphasis on job market stabilization and improving people’s livelihoods. The absence of a growth objective means Beijing will not use stimulus to meet its longstanding goal of doubling 2010 GDP by 2020.

Although the quantitative target was omitted, there is an official nominal GDP growth assumption of 5.4% for 2020 implied by this year’s fiscal deficit goal of 3.76 trillion yuan ($527 billion) or 3.6% of GDP. Based on the consumer price index inflation target of 3.5%, Beijing’s underlying expectation for real GDP growth is around 1.9% for 2020 — which is in line with our growth forecast of 2%.

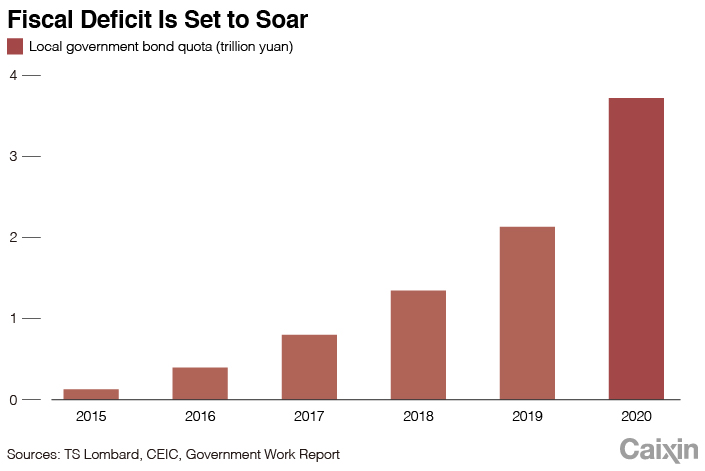

The report pledges a “more proactive” fiscal policy in 2020. The official budget deficit target was raised 80 base points to 3.6% of GDP. Special local government bond issuance quota also rose substantially up 74% year-on-year to 3.75 trillion yuan. Proceeds from 1 trillion yuan Covid-19 special treasury bond will be transferred directly to city- and county-level local governments for public spending.

|

Infrastructure growth revival

While the report does not provide total infrastructure investment targets, it places a policy focus on “new infrastructure” and new style urbanization construction. The much-hyped new infrastructure investment includes high-speed rail and 5G networks but is neither new nor sufficiently large to drive up fixed asset investment growth. The new style of urbanization construction, however, which includes building public facilities and increasing urban service provision, is more significant. We have long highlighted the considerable scope to increase urban services infrastructure investment. The policy focus will support 2020 growth and boost household service consumption down the line.

The report confirms our expectation of a classic China infrastructure stimulus. Indeed, the stimulus is already under way. Our high frequency trackers — including cement prices and heavy-duty truck and excavator sales — show that infrastructure investment is ramping up. The easing of local government financing vehicle borrowing restrictions and the newly launched infrastructure real estate investment trust pilot program will provide additional funding support. The increased bond issuance quota, the acceleration of credit growth and the political “all clear” signal from the NPC all point to infrastructure investment accelerating further in the coming months.

|

Officials reiterated that prudent monetary policy will be more flexible and appropriate, specifying that M2 and total social financing (TSF) growth should be significantly above the 2019 rate. This is in line with earlier People’s Bank of China signals that “controlling macro leverage” is no longer a priority. In our view, the bank will further step up easing measures, including guiding down the loan prime rate, keeping liquidity abundant and expanding credit facilities to support targeted sectors. Consequently, we expect credit growth to continue to increase: TSF growth will reach 14% by end-2020, well above the 10.7% recorded in 2019. In addition to stronger bank loans and bond issuance, we expect the easing of shadow banking regulations to help small and medium enterprises and therefore support employment.

Meanwhile, banks will extend loan relief to smaller businesses until March 2021.

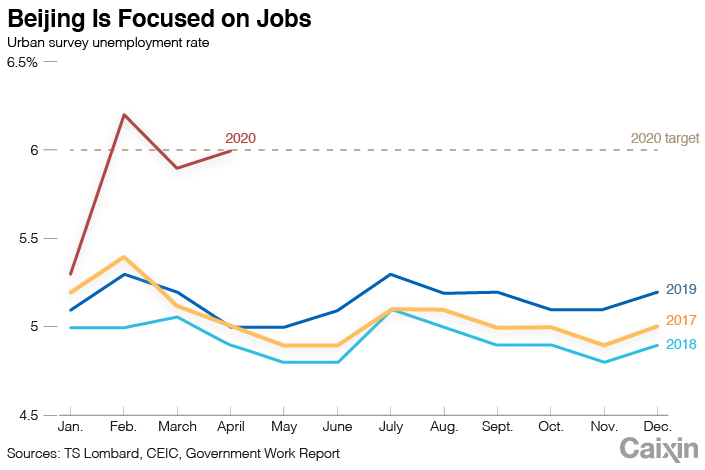

Beijing set a target of creating 9 million new urban jobs, 2 million fewer than last year and a surveyed urban unemployment rate 50 base points higher — at 6%. Despite the swift resumption of industrial production, unemployment remains high: the urban rate was 6% in April, up from 5.2% in December. The real number is much higher as headline indicators do not cover all 291 million migrant workers. Moreover, a weak recovery in consumption means the services sector, the key job generator in the last five years, will take time to return to normal employment levels.

No housing stimulus, for now. On property, the core message remains “homes are for living in, not for speculation.” This means national property easing is unlikely in the near term. However, given the massive contraction in fiscal revenue growth this year and significant employment pressure, we think that property stimulus with more prime land auctions and housing construction activity is not only still likely but will, in fact, be necessary after the third quarter of 2020.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

- GALLERY

- PODCAST

- MOST POPULAR