Tencent’s Online Bank Gets Nod to Open Hong Kong Subsidiary

Listen to the full version

What’s new: WeBank Co. Ltd. has been cleared to set up a tech subsidiary in Hong Kong, as the Tencent Holdings Ltd.-backed online lender looks to expand into new markets.

The Shenzhen office of the National Financial Regulatory Administration released an approval on Friday for WeBank’s application, allowing it to set up the wholly owned company with $150 million.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- WeBank has been approved to set up a tech subsidiary in Hong Kong with $150 million, aimed at providing tech services for Belt and Road Initiative countries.

- As of the end of last year, WeBank had 535.6 billion yuan in total assets, with a 13% year-on-year increase, and its revenue grew 11% to 38.4 billion yuan.

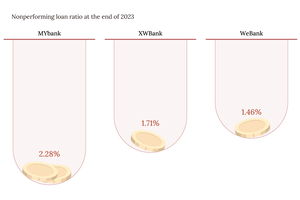

- Retail loans made up nearly 55% of WeBank's total lending by the end of 2023, and its nonperforming loan ratio dropped to 1.46%.

- WeBank Co. Ltd.

- WeBank Co. Ltd., established in 2014, is one of China's leading online lenders, backed by Tencent Holdings Ltd. With total assets of 535.6 billion yuan ($75.6 billion) at the end of last year, the bank saw a 21% rise in net profit to 10.8 billion yuan. It focuses on retail loans and maintains a low nonperforming loan ratio of 1.46%. Recently, it received approval to set up a tech subsidiary in Hong Kong for overseas expansion.

- Tencent Holdings Ltd.

- Tencent Holdings Ltd. is a major backer of WeBank Co. Ltd., an online lender based in China. Tencent is an influential technology conglomerate known for its vast array of internet-related services and products, including social networking, gaming, and financial technology. Their support has been instrumental in WeBank's growth and expansion, including the recent approval for WeBank's tech subsidiary in Hong Kong aimed at providing services to Belt and Road Initiative countries and regions.

- Zhejiang E-Commerce Bank Co. Ltd.

- Zhejiang E-Commerce Bank Co. Ltd., also known as MYbank, is one of China's largest online lenders, backed by fintech giant Ant Group Co. Ltd. It operates alongside WeBank Co. Ltd. in the Chinese online lending space.

- Ant Group Co. Ltd.

- Ant Group Co. Ltd. is a fintech giant backing Zhejiang E-Commerce Bank Co. Ltd., commonly known as MYbank. Like WeBank, MYbank is one of China’s largest online lenders.

- 2013:

- Beijing first announced the Belt and Road Initiative.

- 2014:

- WeBank was set up.

- End of 2022:

- Retail loans accounted for almost 56% of WeBank’s total lending.

- End of 2022:

- WeBank’s nonperforming loan ratio was 1.47%.

- End of 2023:

- Retail loans accounted for almost 55% of WeBank’s total lending.

- End of 2023:

- WeBank had 535.6 billion yuan in total assets, an increase of 13% year-on-year.

- End of 2023:

- WeBank’s nonperforming loan ratio dipped to 1.46%.

- End of 2023:

- WeBank's revenue grew 11% to 38.4 billion yuan, and net profit increased 21% to 10.8 billion yuan.

- 2024-06-21:

- The Shenzhen office of the National Financial Regulatory Administration released an approval for WeBank's application to set up a tech subsidiary in Hong Kong.

- GALLERY

- PODCAST

- MOST POPULAR