In Depth: Consumers, Entrepreneurs Give Banks’ Retail Lending a Much-Needed Boost

Listen to the full version

Despite market saturation stunting the credit card business and a property market downturn curbing mortgage demand, Chinese banks have seen a rise in their overall retail loans after pivoting toward other consumer lending and individual entrepreneurs in search of growth.

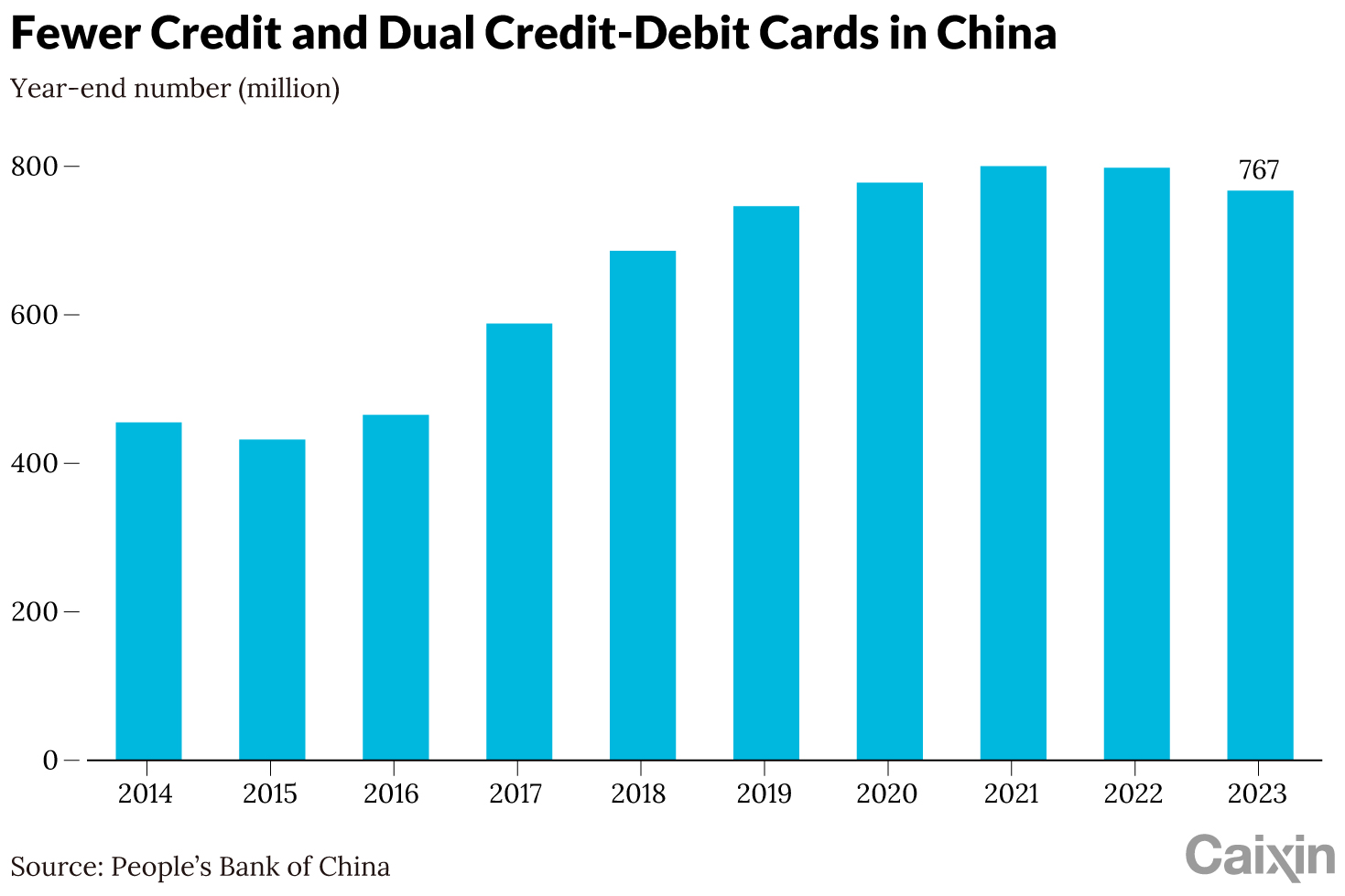

As of the end of last year, the number of credit and dual credit-debit cards in China fell 3.9% year-on-year to 767 million, down from the peak of 807 million in 2022, according to data from the People’s Bank of China (PBOC).

|

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Chinese banks saw retail loans rise by 5.1% year-on-year by the end of March, despite a 1.9% drop in personal mortgages and a 3.9% decline in credit card numbers.

- Non-mortgage consumer loans and personal business loans surged, growing 8.7% and 15.4%, respectively.

- Banks are emphasizing growth in non-mortgage consumer loans and personal business loans to counter shrinking mortgage and credit card sectors.

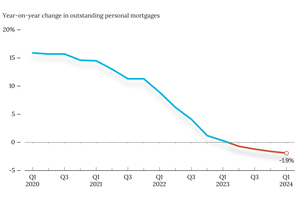

Despite the challenges of market saturation in the credit card sector and a downturn in the property market, Chinese banks have managed to increase their overall retail loans by focusing on other forms of consumer lending and loans to individual entrepreneurs [para. 1]. The number of credit and dual credit-debit cards in China decreased by 3.9% year-on-year to 767 million in 2023, down from the peak of 807 million in 2022, according to the People’s Bank of China (PBOC) [para. 2]. Conversely, the country’s outstanding personal mortgages fell by 1.9% year-on-year by the end of March 2023, marking the fourth consecutive quarterly decline [para. 4].

Despite these declines, overall outstanding retail loans grew by 5.1% year-on-year by the end of March. Consumer loans excluding mortgages increased by 8.7%, while personal business loans surged by 15.4% [para. 5]. Peng Jiawen of China Merchants Bank (CMB) noted that credit card loans and housing mortgages had historically experienced rapid growth and were priced with relatively high interest rates. However, growth in these areas slowed last year, leading to a decline in their contribution to CMB’s total loans [para. 7].

Banks have shifted their focus to non-mortgage consumer loans, which target creditworthy consumers, as a way to offset slowing credit card and mortgage businesses. Despite this, industry insiders acknowledge limitations on growth given the focus on higher-quality borrowers [para. 8]. Growth in personal business loans could ease long-standing financing difficulties faced by individual entrepreneurs and small business owners but is hampered by a lack of credit information [para. 9].

Several factors contribute to the shrinking mortgage sector, including the overall property market downturn and increasing early repayments by homeowners. China’s efforts to stimulate housing demand through repeated cuts to its mortgage reference rate have led homeowners to repay loans early to reduce borrowing costs. For instance, the mortgage reference rate was cut to 3.95% in February [para. 11][para. 13]. Li Yun of China Construction Bank Corp. (CCB) observed a decrease in early repayments after the government instructed banks to reduce interest rates on existing first-home mortgages in August, aiming to slow early repayments [para. 14].

The credit card business also faced declines, with Ping An Bank reporting an 11.2% year-on-year drop in outstanding credit card loans to 514 billion yuan ($72.6 billion) by the end of last year. Industrial Bank Co. Ltd. and China Everbright Bank Co. Ltd. saw decreases of 11.3% and 6.5%, respectively [para. 17].

To compensate for the decline in mortgage income, major Chinese banks recorded double-digit growth in both non-mortgage consumer loans and personal business loans last year [para. 18]. Non-mortgage consumer loans offer higher returns than mortgages and are deemed better-quality assets compared to credit card loans, according to CMB’s Zhu Jiangtao [para. 21]. These loans are also encouraged by government policies to stimulate consumer spending, leading to a competitive environment among banks to attract customers with low interest rates [para. 23].

Non-mortgage consumer loans, however, cannot fully replace mortgages due to their inherent advantages, such as being secured by collateral and carrying high interest rates with safety [para. 28]. By the end of March, mortgages constituted 47% of the total 81.5 trillion yuan in outstanding retail loans [para. 29]. Banks are advised to integrate services from different segments to boost growth in retail lending. For example, several banks, including Chengdu Rural Commercial Bank Co. Ltd., have merged their credit card departments with retail lending departments to create synergies [para. 32][para. 34].

- China Merchants Bank Co. Ltd.

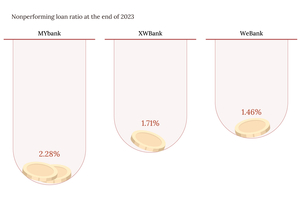

- China Merchants Bank Co. Ltd. (CMB) experienced slowed growth in credit card loans and housing mortgages, which historically had high interest rates. Peng Jiawen, an executive vice president, confirmed the slowdown last year. The bank is now focusing on non-mortgage consumer loans as a key growth strategy. These loans target high-quality borrowers and are considered better assets compared to credit card loans. At the end of last year, CMB's nonperforming consumer loan ratio was 0.9%.

- China Construction Bank Corp.

- Li Yun, an executive vice president of China Construction Bank Corp. (CCB), mentioned that the bank saw a decrease in early mortgage repayments in the first three months of this year compared to the previous quarter, thanks to regulatory measures reducing interest rates on first-home mortgages, aimed at curbing early repayments.

- Ping An Bank Co. Ltd.

- Ping An Bank Co. Ltd. faced a significant decline in its credit card business, with outstanding credit card loans shrinking 11.2% year-on-year to 514 billion yuan ($72.6 billion) by the end of last year. This decline is part of broader challenges for the credit card sector in China amidst shifting focus towards consumer and personal business loans.

- Industrial Bank Co. Ltd.

- Industrial Bank Co. Ltd. experienced a year-on-year decrease of 11.3% in its outstanding credit card loans, as stated in their annual report. This decline parallels the broader trend of shrinking credit card and mortgage businesses among Chinese banks.

- China Everbright Bank Co. Ltd.

- China Everbright Bank Co. Ltd. reported a 6.5% decrease in outstanding credit card loans year-on-year at the end of last year, as detailed in their annual report. The bank's shift away from credit card loans reflects broader industry trends of focusing on non-mortgage consumer loans and personal business loans to offset declining mortgage and credit card demands.

- China Minsheng Banking Corp. Ltd.

- China Minsheng Banking Corp. Ltd. has integrated its credit card and retail lending departments to create synergy. This merger aims to eliminate internal competition and enhance cooperation between departments. The bank is focusing on combining services from different segments to attract more users for their consumer loan products, particularly through credit cards.

- Chengdu Rural Commercial Bank Co. Ltd.

- Chengdu Rural Commercial Bank Co. Ltd. has recently merged its credit card department with its retail lending department. This merger aims to create synergy by eliminating internal competition for customers, allowing for integrated services and better growth in retail lending.

- 2022:

- The peak number of credit and dual credit-debit cards in China reached 807 million.

- September 2023:

- Chinese regulators told banks to boost consumer financing and reduce the cost to stimulate spending.

- By the end of last year:

- The number of credit and dual credit-debit cards in China fell 3.9% year-on-year to 767 million.

- End of last year:

- Ping An Bank Co. Ltd. reported that its outstanding credit card loans shrank 11.2% year-on-year to 514 billion yuan.

- End of last year:

- Industrial Bank Co. Ltd. saw a decrease of 11.3% in outstanding credit card loans year-on-year and China Everbright Bank Co. Ltd. saw a decrease of 6.5%.

- End of last year:

- CMB's consumer loans had a nonperforming ratio of 0.9%, compared to 4.3% for its credit card segment.

- February 2024:

- China's latest cut to its five-year-plus loan prime rate reduced the mortgage reference rate to 3.95%.

- February 2024:

- National banks’ average rate on online consumer loans trended down to about 3.2% from 4% a year earlier.

- March 2024:

- Peng Jiawen from China Merchants Bank Co. Ltd. (CMB) mentioned that the growth of credit card loans and housing mortgages slowed last year.

- End of March 2024:

- China's outstanding personal mortgages fell 1.9% year-on-year, marking the fourth straight quarter of decline.

- End of March 2024:

- Overall outstanding retail loans in China grew 5.1% year-on-year, with consumer loans excluding mortgages growing 8.7% and personal business loans surging 15.4%.

- End of March 2024:

- Out of the 81.5 trillion yuan in outstanding retail loans, 47% were mortgages.

- GALLERY

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新